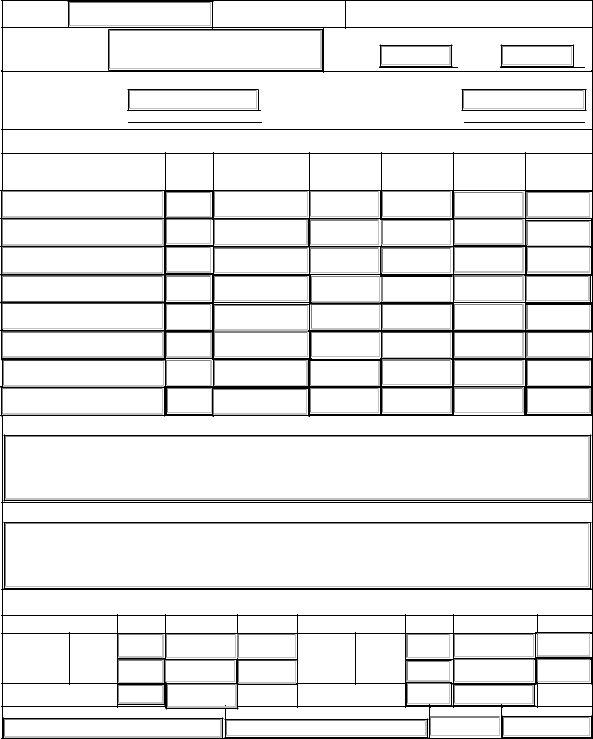

Form 204

Form 204 - Web use form std 205, payee data record supplement to provide a remittance address if different from the mailing address for information returns, or make subsequent changes. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. 204) must be obtained from a supplier prior to executing any procurement if the supplier is not a government entity. It contains information such as payee name, entity. Learn how to fill out the form, when to file it, and how to pay your tax liability. Learn how to file, pay, and check the status of your extension online or by mail.

Employer's quarterly federal tax return. Learn how to fill out the form, when to file it, and how to pay your tax liability. Learn how to file, pay, and check the status of your extension online or by mail. It contains information such as payee name, entity. Web if you are a u.s.

Web a completed payee data record (std. Web purpose of form 204. Web arizona form 204 is used to apply for an automatic extension to file an individual income tax return. Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s. Tax on certain types of income,. List of creditors who have the 20 largest unsecured claims and are not insiders.

Chapter 11 or chapter 9 cases: Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Web a payee data record (std 204) is required for each vendor conducting business with or receiving payment from the state of california.

Web Use Form Std 205, Payee Data Record Supplement To Provide A Remittance Address If Different From The Mailing Address For Information Returns, Or Make Subsequent Changes.

Tax on certain types of income,. Use arizona form 204 to apply for an extension of time to file arizona forms 140, 140a, 140ez, 140et, 140ptc, 140py, or 140nr. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. 204) must be obtained from a supplier prior to executing any procurement if the supplier is not a government entity.

Chapter 11 Or Chapter 9 Cases:

Web purpose of form 204. Resident alien who is relying on an exception contained in the saving clause of a tax treaty to claim an exemption from u.s. Web std.204 is a form for reporting payments to individuals or entities that are not governmental entities. List of creditors who have the 20 largest unsecured claims and are not insiders.

Web The Purpose Of The Std.

Web arizona form 204 is used to apply for an automatic extension to file an individual income tax return. It is required by tplrd for reimbursement or payment requests. It contains information such as payee name, entity. Web form 204 is a document for forming a professional entity in texas that provides a specific professional service, such as medicine, law, or psychology.

Employer's Quarterly Federal Tax Return.

204 form is to obtain payee information for income tax reporting and to ensure tax compliance with federal and state law. Learn how to file, pay, and check the status of your extension online or by mail. Web arizonans may use state form 204 for an extension but don't need to submit this if filing a federal extension request with the irs. Only 44% of more than 1,000.