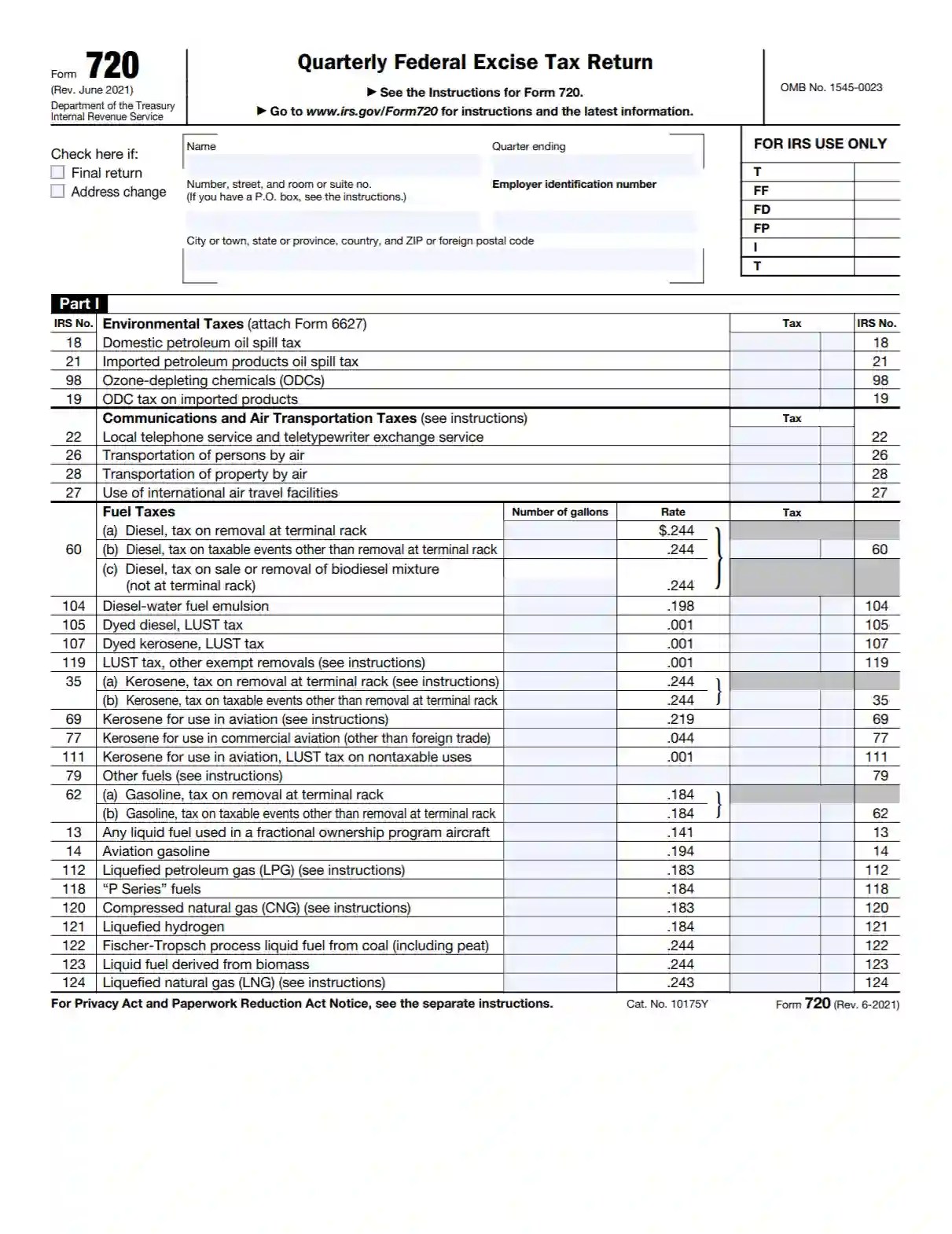

Irs 720 Form

Irs 720 Form - If your expat business deals in those particular products, the irs requires that you file. The form has two parts: Web irs form 720 is used to report and pay various federal excise taxes, such as fuel, communications, air transportation, and insurance taxes. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. The form is the information reporting return for taxpayers that must pay federal excise taxes. Find the latest updates, instructions, and faqs for.

Web purpose of form 720: The quarterly federal excise tax return is used to file and pay excise taxes due on a quarterly basis to keep liabilities under control. Web download or print the 2023 federal form 720 (quarterly federal excise tax return) for free from the federal internal revenue service. You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. Web you don't import gas guzzling automobiles in the course of your trade or business.

If your expat business deals in those particular products, the irs requires that you file. Web irs form 720, officially titled the quarterly federal excise tax return, is a pivotal tax form for reporting and remitting federal excise taxes. The form has two parts: Web irs form 720 is used to calculate and pay excise taxes on certain products and services, such as alcohol, tobacco, fuel, and airline tickets. Find out the latest rates, rules, and developments for 2021, including. Web learn how to file form 720 to report and pay federal excise taxes on fuels, transportation, and health care.

Web under us federal regulations, certain products are subject to an excise tax. Web irs form 720 is a quarterly tax return for businesses that sell products or services subject to excise tax, such as gasoline, airline tickets, or indoor tanning. The form is the information reporting return for taxpayers that must pay federal excise taxes.

We Will Use The Completed.

You aren't required to file form 720 reporting excise taxes for the calendar quarter, except. Web learn how to file form 720 to report and pay federal excise taxes on fuels, transportation, and health care. Web irs form 720 is used to calculate and pay excise taxes on certain products and services, such as alcohol, tobacco, fuel, and airline tickets. Find out the latest rates, rules, and developments for 2021, including.

Web What Is Form 720?

The form is the information reporting return for taxpayers that must pay federal excise taxes. Web irs form 720 is a quarterly tax return for businesses that sell products or services subject to excise tax, such as gasoline, airline tickets, or indoor tanning. Learn who needs to file, how to fill out. If your expat business deals in those particular products, the irs requires that you file.

Find The Latest Updates, Instructions, And Faqs For.

Web you don't import gas guzzling automobiles in the course of your trade or business. It includes three parts, plus schedule a. Web under us federal regulations, certain products are subject to an excise tax. The form has two parts:

Web Download Or Print The 2023 Federal Form 720 (Quarterly Federal Excise Tax Return) For Free From The Federal Internal Revenue Service.

Web learn how to use form 720 to report and pay excise taxes for various activities, such as aviation, highway, fuel, and tobacco. Web irs form 720, officially titled the quarterly federal excise tax return, is a pivotal tax form for reporting and remitting federal excise taxes. Web irs form 720 is used to report and pay various federal excise taxes, such as fuel, communications, air transportation, and insurance taxes. The quarterly federal excise tax return is used to file and pay excise taxes due on a quarterly basis to keep liabilities under control.