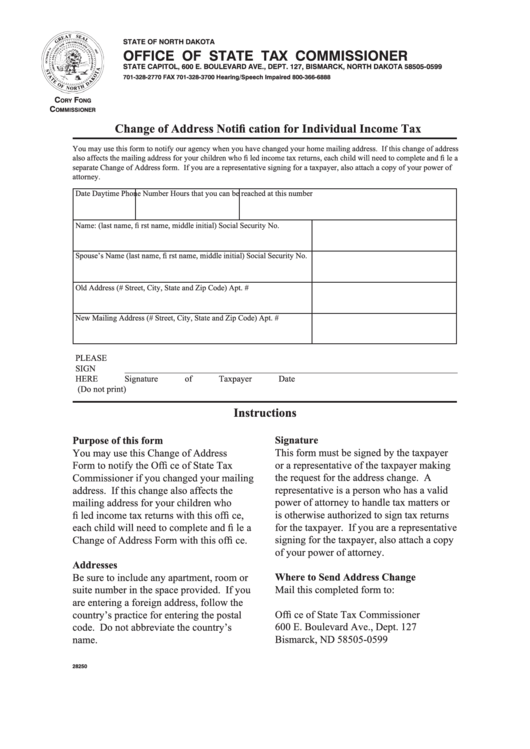

North Dakota State Tax Form

North Dakota State Tax Form - We last updated the individual income tax. To find tax forms for the current and previous tax years, visit our forms library where you can search by form name, tax type, tax year, and sfn. Web complete the respective north dakota tax form (s) then download, print, sign, and mail them to the north dakota state tax commission. Tap allows north dakota business taxpayers to electronically file returns, apply for permits,. Information on how to only file. Web to register to collect and remit applicable sales and use tax in north dakota only, complete the online application on nd tap.

Trusted by millionsfree trialfast, easy & secureover 100k legal forms Web north dakota accepts the timely filed federal extension request as an extension to file the state return. Web if you owe use tax to north dakota, you must file a north dakota use tax return using the one time remittance form. Web north dakota has a state income tax that ranges between 1.1% and 2.9%, which is administered by the north dakota office of state tax commissioner. Web the nd tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in nds.

Web north dakota accepts the timely filed federal extension request as an extension to file the state return. Web north dakota has a state income tax that ranges between 1.1% and 2.9%, which is administered by the north dakota office of state tax commissioner. Tap allows north dakota business taxpayers to electronically file returns, apply for permits,. You can obtain it from our website at www.tax.nd.gov, or. With the launch of the new website also comes the. Web how to complete form 307.

Web how to complete form 307. We last updated the individual income tax. If the federal return is not being extended but additional time is needed to.

Web To Register To Collect And Remit Applicable Sales And Use Tax In North Dakota Only, Complete The Online Application On Nd Tap.

Web how to complete form 307. Web the nd tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow for single, joint and head of household filing in nds. To find tax forms for the current and previous tax years, visit our forms library where you can search by form name, tax type, tax year, and sfn. Web north dakota has a state income tax that ranges between 1.1% and 2.9%.

We Last Updated The Individual Income Tax.

With the launch of the new website also comes the. Information on how to only file. Web complete the respective north dakota tax form (s) then download, print, sign, and mail them to the north dakota state tax commission. Web manage your north dakota business tax accounts with taxpayer access point (tap).

Web North Dakota Tax Forms.

You can obtain it from our website at www.tax.nd.gov, or. Health · events · personal finance · planning · notices & certificates Web north dakota has a state income tax that ranges between 1.1% and 2.9%, which is administered by the north dakota office of state tax commissioner. Web if you owe use tax to north dakota, you must file a north dakota use tax return using the one time remittance form.

These 2023 Forms And More Are Available:

Web north dakota accepts the timely filed federal extension request as an extension to file the state return. Apply for a north dakota sales & use tax. Tap allows north dakota business taxpayers to electronically file returns, apply for permits,. Trusted by millionsfree trialfast, easy & secureover 100k legal forms